Question:

Hi,

Thanks for getting back to me.

So this week was another frustrating one for me instead of being a pretty good one potentially.

Breakeven again! lol

I have included a couple of screenshots with annotations and I would be really grateful if you could take a look.

I traded a continuation pin on NZDUSD and got stuck in it and miss out on trading the news. I found the book you suggested ‘beat the forex dealer’ by A Silvani to be an awesome read! Thanks

You mention that your trading has evolved over the last few years, may I ask how?

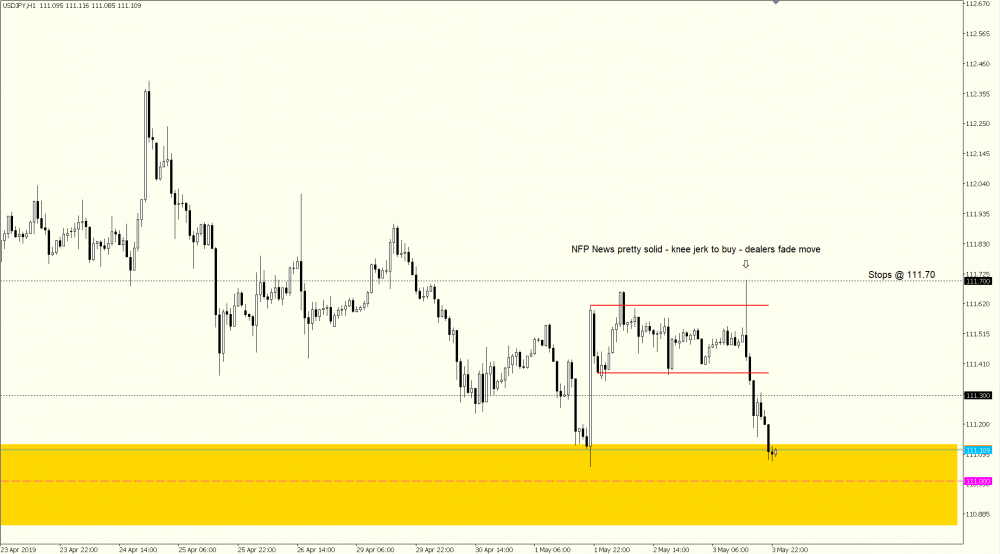

I myself have started to trade news events looking to ‘gun for stops’ ect or rather just fading the ranges set after releases but it all happens so fast sometimes the price action just never forms but I have noticed this particular sort of engulf type setup which is quite hard to explain I will attach a screenshot.

Anyway, in terms of questions my main queries are in regards to trade management and take profits. After reading your books I know to look for a change in structure but it’s the timeframe that I need to be looking for this change in structure I struggle with.

If for instance, I am trading what becomes a new daily up/down swing then should I be holding the trade until i see a chnae of structure (ie. take profits) on the daily timeframe?

Let’s assume that I traded a 1hour pattern or found an entry of some sort.

Also what do you think I should have done with the NZDUSD trade?

I know now of course that I should have closed it but what is your view on opening up another position on a coprrelated pair if you currently have no ‘risk’? ie moved stop to breakeven.

I still have it programmed in head that you shouldn’t trade correlated pairs as your just effectively hedging or doubling down etc but I know I also need to think dynamically and adapt to changing market conditions.

For example, I traded another continuation pin a while back and towards the top of the swing down (I was trading an uptrend) a reversal pin formed and I heard a voice in the back of my mind say ‘if you think the market direction is changing then quickly, reverse your position!’ this of course I found rather hard to do!

I know that it’s my fear of uncertainty is holding me back, don’t get me wrong i’ve taken some pretty bad trades that I look back on and think Ergh!

But i’ve also taken some really good trades that turned out to be momentum moves that had I not taken profits early would have alone made me some decent money by now. Looking back I am actually both horrified and impressed by my ability to go round in circles.

I guess what I am missing is exactly what defines a good trader.

The lack of fear.

Unitl the point that I enter the trade i’m usually objective, I never chase price ect but then I turn into the very fearful creature I seek to profit from the minute a profitable position turns against me!

I am getting better but damn it’s hard, I just don’t ‘know’ what the correct decision is. I just want to make the ‘right call’ regardless of win or loss.

I suppose this is know as ‘fear of being wrong’?

Also, you mentioned about price breaking above/below a high/low by x pips and confirming the market direction. Will there be an article explaining how to do it in the even of a change in volitility? Because I’ve notice some pairs change and i’ve then been unsure about the distance ect , also on cross pairs for instance.

I’ll leave it there as I’m sure your already getting fed up of how many questions I have.

Thanks

My Response:

Don’t Sweat It – Breaking even beats a loss, right?

The key here is to stay focused…

Now, onto your questions.

Q1. You had a bit of tough luck with this pin… The pin itself was fine, but its timing – just before the NFP – made it a bit of a toss-up. I think moving the stop to breakeven was the key mistake. I understand why you did it—price dropped—but with the NFP on the horizon, a price rise or spike was highly likely.

Q2. I’ve attached an image to better explain my thoughts about this zone.

In essence, this zone was still valid despite the price break and its age exceeding 24 hours, due to its proximity to the consolidation.

Q3. I can’t say if I would have made that exact move, but in hindsight, I might have taken a shot…

Q4. Your question is a bit unclear… Are you asking if you should have traded the USD/JPY stop run because the order book confirmed stops were there instead of trading the NZD/USD stop run where you didn’t have confirmation?

Please clarify, and I’ll be happy to answer.

Q5. My trading has evolved over the years.

I focus a lot on significant round number prices and watch for major reversals at these prices. I use supply and demand zones alongside these figures for timing reversals and entering trades. Round number prices seem to hold significant sway when it comes to triggering large trend changes.

Q6. Regarding profit-taking…

Yes, stick to the 1-hour timeframe, but always keep the daily trend in sight.

Q7. As for trading correlated pairs, it sounds like an interesting idea… It’s worth experimenting with, I think.

Q8. I don’t plan to write an article on that old method… It’s too subjective. I still check whether a small distance from the prior low indicates banks buying, but I don’t use exact pip numbers to detetermine whether the new low has formed too far away from the previous low.

Q9. Seems like you’re too caught up in the ‘perfect’ decision…

Just remember, there’s rarely a pure right or wrong choice. We’re working with incomplete information and a complex, unpredictable market.

Our decisions hinge on the info and understanding we possess…

For example: you’re sitting in a profitable trade.

Suddenly, price hits a supply zone and starts falling… Assuming you were long, you exit the trade, anticipating a further drop.

But surprise!

Price reverses and skyrockets through the zone.

So, was your exit a bad call? Nah!

At that moment, there was no way to know the upswing was imminent… Hence, you shouldn’t feel any regrets.

Here’s a tip:

Try to get a trade open into long-term trends on a higher timeframe.

At the same time, continue with your 1-hour chart trades (or any other timeframe you trade). If you have a long-term trade making profit, the outcomes of your short-term trades will stress you out less. This relaxed mindset can sharpen your decision-making and reduce the obsession with always being right.

Consistently profitable long-term trades are easier said than done, obviously, but giving it a shot won’t hurt.

Hope this helps,

PAN.