In my book “Supply And Demand: How To Find The Best Zones” I explain that the best way to find high probability zones is to look at the size and duration of the trend or movement that took place immediately before a zone formed.

This is a good method, it identifies some nice zones.

But it’s not without issues…

For one, understanding how to analyze the prior trend/movement isn’t easy and requires a deep level of knowledge about the market. In addition, the zones that do have a high chance of being successful (the ones that form after long rises/declines) are pretty rare, so it’s not a great way to find zones if you trade frequently.

So finding high probability zones is clearly pretty tough… but what if there was a different way?

What if there was a way to find good zones that doesn’t require a deep understanding of the trend or market and that could be used by a beginner trader?

Well, as it happens, there is a way…

A New Way Of Finding Zones

In my “Why Round Numbers Make Great Support And Resistance Levels” post, I explain how most large reversals begin when the price is at or near a big round number – a price that ends in 500, 000 and 000.

The reason they begin here is that the banks and other big players use them as points to place, close and take profits, as it’s a point where lots of other traders/institutions buy and sell, which makes it easy for them to buy and sell themselves via placing, closing and taking profits.

The reason they begin here is that the banks and other big players use them as points to place, close and take profits, as it’s a point where lots of other traders/institutions buy and sell, which makes it easy for them to buy and sell themselves via placing, closing and taking profits.

Now here’s the important bit…

When the banks place, close or take profits they do so at or near the points where they have before – this will be familiar to any of you who have read my book.

Supply and demand zones form as a result of the banks placing, closing or taking profits. And the reason the price returns to them is that they want to place, close or take more profits at a similar point to where they have before.

So if we know where the banks are most likely to place, close and take profits (big round numbers), and at which specific point they’re likely to do this (supply and demand zones), if we combine the two together we should be able to find some high probability zones.

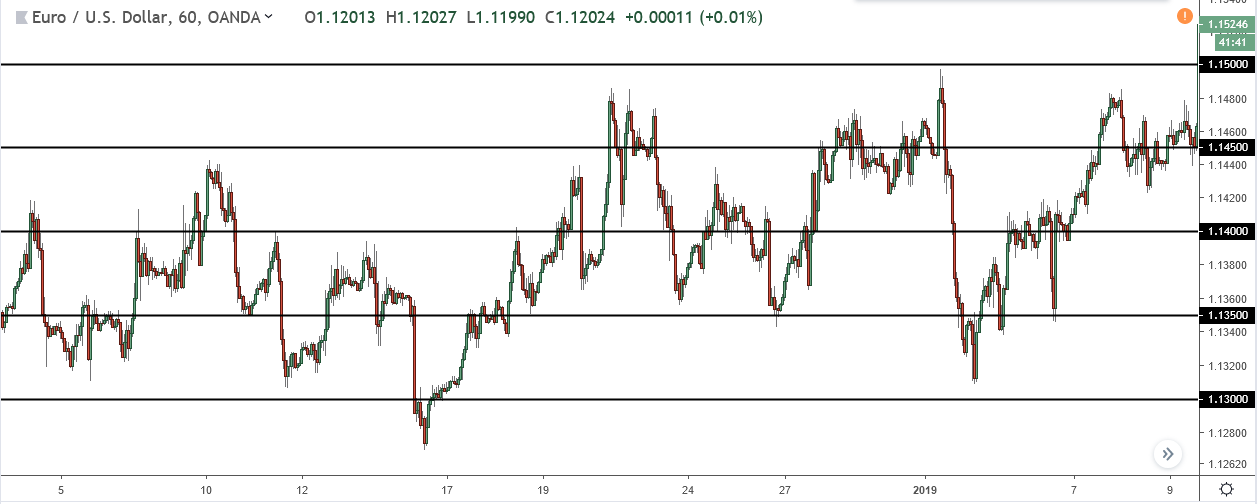

Here are the round numbers I showed at the beginning of this section.

Here are the round numbers I showed at the beginning of this section.

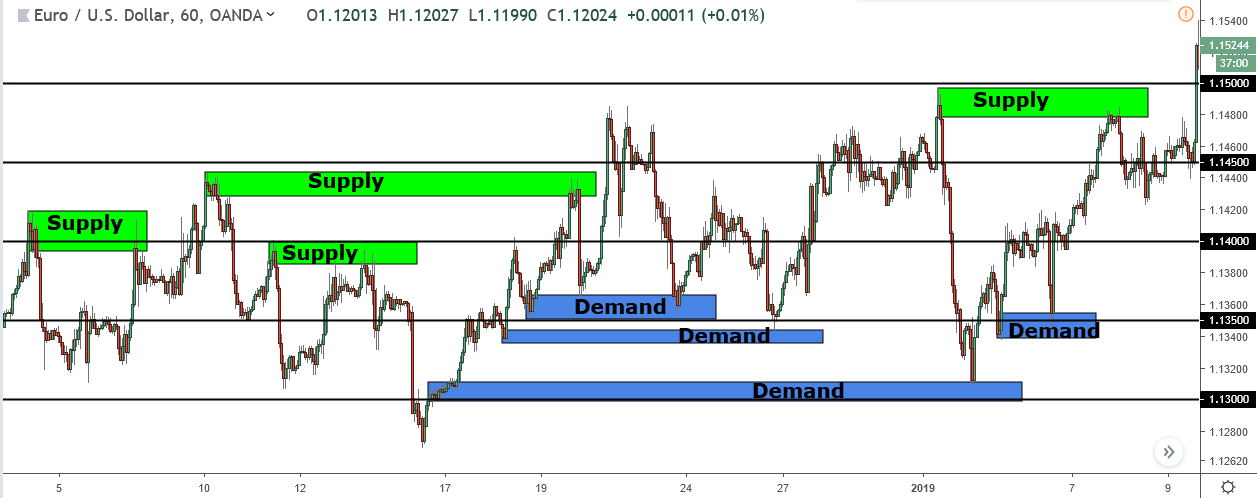

And here they are again but with the nearby supply and demand zones marked.

And here they are again but with the nearby supply and demand zones marked.

It’s obvious that most of the zones that formed at or near the big round numbers ended up being successful and caused price to reverse.

This is what I mean by using the levels to find high probability zones.

By looking for the zone that forms at or near the BRN’s, you can locate where the banks and other big players are likely to place, close or take profits, and thus… where the price is likely to reverse.

Not bad, eh?

How To Use Round Numbers To Find High Probability Zones

One of the great things about this method of finding high probability zones is that compared to other methods – such as the one spoken about in my book – it’s very quick and easy to use, making it perfect for beginner S & D traders.

To find the zones, mark the big round numbers closest to the price on the chart…

Now locate the zones that have formed either at or very close the big round number lines…

…And then mark them in the same way you would normally using the rectangle tool.

…And then mark them in the same way you would normally using the rectangle tool.

Now you can start monitoring them for entries into trades.

Easy.

Summary

Finding high probability supply and demand zones will never be a walk in the park, and even though this method will provide you with many good zones, they won’t work all of the time.

So make sure you continue to keep your risk low and remain vigilant when trading the zones.

👍👍👏👏

Oh man, is it really demand zone in the picture above? https://www.priceactionninja.com/wp-content/uploads/2019/04/Screenshot-1580.png