Question:

Hi PAN

I hope you are well.

I collated a number of your reversals and pullbacks articles which I have been reading back to back to get a concentrated dose of info, which has been great!

I have a few questions for you…

1) In general, from what you write, it appears that the actual moves resulting from reversals (in any situation) are actually created by the retail traders as opposed to the actual buying or selling actions of the bank traders?

In all the cases I have read in all your articles the same theme comes through….I can totally see the psychology at play and the ‘manipulation’ of the retail traders at work, but I find it strange that if the banks are placing large orders, consuming all of the opposing retail orders at a given level, that that action itself does not create the initial move?

Is it very precisely calculated by the banks exactly how much opposing orders are in the market and therefore how much exactly the banks know they consume?

Do they add a bit more on (so to speak!) to make some sort of initiatory move, allowing the retail traders to do the rest of the work?

2) I can understand that the banks want to minimise their risk and therefore will outlay the minimum they can and maximise the affect created by retail trading activity….Do you have any more detail on how the banks make these decisions?

It would be really interesting to hear if you do….

3) With regards to deep pullbacks…I totally get the principle.

I have thought about this type of reversal and it seems to me that an existing trend can only be deemed as over when there is a pulback into the existing trend and then a deep pull back which stops at the 70%-90% retracement back into the trend pullback, thereby not creating a new high?

From that point, more bank orders come in at the 70-90% levels initiating the trend reversal in the opposite direction, the size of which is dependent on the visibility and therefore number of traders to fuel this reversal.

4) With regards to consolidation reversals, can you clarify a comment you make regarding the duration of the consolidation relative to the new trend direction. You say that in your experience, a consolidation that takes place for a long time i.e. 25 weeks+ is a good indication the previous trend is going to continue?

I would have thought it the other way round as the longer the consolidation, the more the traders would have forgotten about the original trend and the range traders would start trading in both directions off of clearly defined range boundaries?

5) This is an important question and one I will backtest myself….with regards to deep pullback reversals (on all time frames) when the 70-90% deep pullback occurs, how reliable a signal is that, that this reversal is set to go?…I guess this goes a bit deeper with regards to SD zones etc, but in general what are your thoughts?

6) I have an interesting question to ask about trend strength and about price ‘drifting’. It was sparked by a comment you made in one of your articles about price of the Euro ‘drifting’ up towards the 1.4000 level prior to the shock reversal.

Im asking this not because of your comment but what it sparked in me and something I have thought about before….Can price really drift?!

Sometimes price can look as though it really is just drifting aimlessly, but in either an up or down direction within some loose sort of trend and/or channel…Is this the absence of bank money?

Is price just continuing to meander higher without any real interest from investors or traders?

Is it just responsive behaviour from the market makers, making daily transactions with no real interest from the institutions?

What are your thoughts?

As always, I really value any answers and information you can share with me when you have time.

Many thanks, regards and cheers,

Response:

Let’s Dive Straight Into Your Questions…

Q1.

About the banks – yes, they do add more to their reversal trades. Why, you ask? To ensure all the market orders are fully absorbed and the market actually shifts direction.

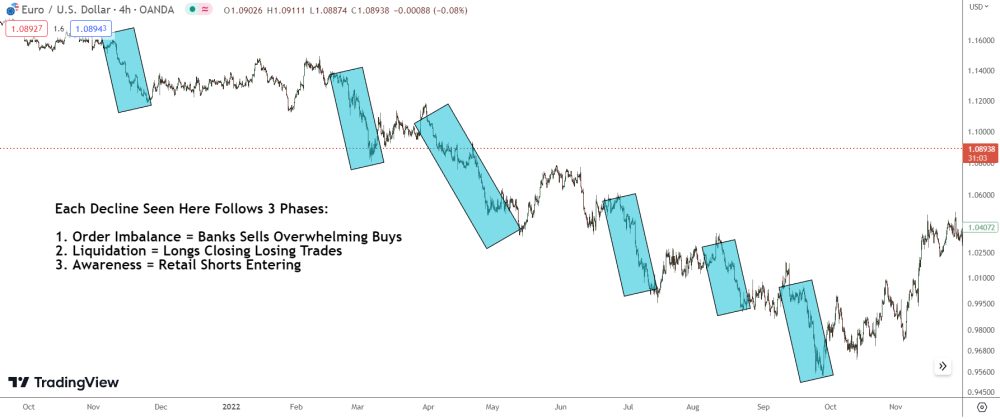

The initial movement (Imbalance) in each reversal is caused by the bank’s trade orders outweighing the market orders from other traders. If you’ve read my ‘Forex Game Theory‘ book, you’ll recall the three phases I discuss for every trend: Imbalance, Liquidation, and Awareness…

The imbalance phase also happens at the onset of each market reversal when banks place their trades.

Q2.

On to deep pullbacks – yes, you’re absolutely correct.

Most trends will end with a deep pullback, but some might end through a consolidation or a sudden reversal.

Q3.

About the consolidation rule… I haven’t tested it too much.

I need to check some reversals on the 1-hour chart and other timeframes to understand if longer consolidations lead to continuations and shorter ones are more likely to cause reversals.

The rationale which sparked my thought was – if a consolidation was set to initiate a trend reversal, it would likely be short in terms of its duration. That’s because the majority of traders would still be placing trades in line with the trend, providing a wealth of orders for banks to place their reversal trades.

Moreover, there would be more retail traders present to cut their losses once the reversal begins, which would generate massive order flow and push price in the direction of the reversal.

Q3.

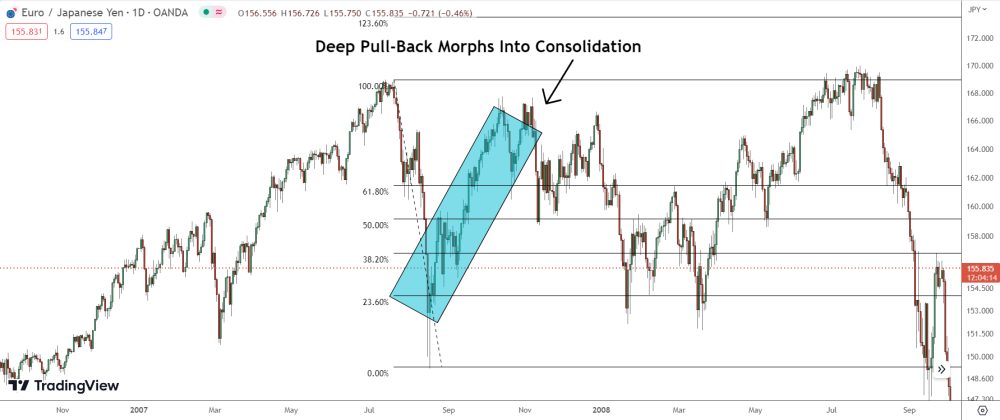

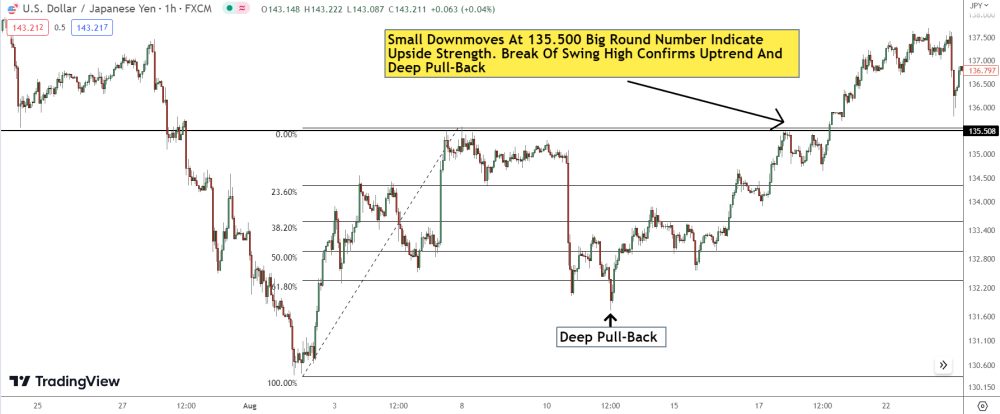

Seeing a deep pullback can often be a reliable indication of an impending market reversal. However, what initially appears as a deep pullback can often morph into something totally different…

For instance, there may be times when a deep pullback forms, but instead of penetrating the prior swing’s high or low, the market veers back in the pullback’s original direction, leading to a consolidation structure.

To determine whether it truly is a deep pullback, watch how the market behaves when it reaches the swing high (if the market is in a downtrend) or the swing low (if the market is in an uptrend) of the deep pullback swing.

If, upon reaching the swing, the market swiftly reverts back to the direction from which the deep pullback originated, it could signal that a consolidation is brewing or the existing trend will persist.

Q5.

As for price drifts, honestly, there could be a ton of reasons depending on the timing and location of when the drift starts… It might be due to a lull in market activity, with retail traders causing the drift through their trading activities.

Alternatively, it could stem from market makers manipulating the orders…

In my view, there’s no definitive way to pinpoint the cause…

Hope this helps!

PAN.