Commitment Of Traders Graph (Cot Report)

The Commitments of Traders (COT) graph reveals the positions held by major financial institutions – banks, hedge funds, and asset managers – providing invaluable insights into the positioning and decison making of the Smart Money.

Key Features of the COT Graph:

Open Interest: See the total number of contracts (trades) held by non-commercial traders.

Long/Short Positions: Track whether institutions are predominantly bullish or bearish.

Trend Strength: Identify continuations/reversals via changes in institutional positioning.

The COT Graph can provide key insights – if you know how to decipher it.

The graph visually tracks changes in open long/short positions, highlighting the actions of real market movers: the non-commercial traders like banks and hedge funds. Forget about hedgers (commercial traders); they’re not the ones driving the major trends we see.

Reading the COT Report: The Key is in the Changes

To understand the COT report, you need to zoom in on the non-commercial traders’ numbers. Don’t just look at the latest figure; compare it to the previous one and see how it’s been trending recently.

These changes reveal the banks’ moves:

Net-longs INCREASE: Banks piling into LONG trades – current up-trend should continue.

Net-longs DECREASE: Banks closing LONG trades – expect retracement or consolidation

Net-Shorts INCREASE: Banks jumping into SHORT trades – downtrend should continue.

Net-Shorts DECREASE: Banks closing SHORT trades – watch for retracement/consolidation.

DON’T FORGET: A large net increase or decrease in COT positions indicates a significant shift in sentiment among traders, which can have a major impact on price action.

Key Questions To Ask Using The Cot:

1) Are non-commercials (Banks/Hedge Funds) net long or net short?

2) How have net long/short positions changed over time?

3) Are there any extreme levels in net long/short positions?

4) Have there been recent significant changes in positioning that could impact your trade?

5) Is there a historical correlation between COT data and price movements for this market?

Remember: Never look at the numbers in isolation!

Always analyze the changes and the overall trend.

By asking these questions and monitoring the COT graph, you’ll gain a clear edge in understanding market sentiment and anticipating the banks/hedge funds next move.

How to Use the COT Graph: 3 Key Applications for Smarter Trades

The Commitments of Traders (COT) graph reveals a number of insights, offering multiple ways to enhance your trading and analysis. From identifying trends and anticipating reversals to gauging market sentiment, the COT can provide many market insights.

Decoding the Current Trend

Trends are born from the actions of smart money buying and selling in large volumes.

The COT report allows you to track their moves, observe whether their buying or selling is increasing or decreasing, and quickly gauge the current trend’s direction and strength.

Let’s look at how this works in practice…

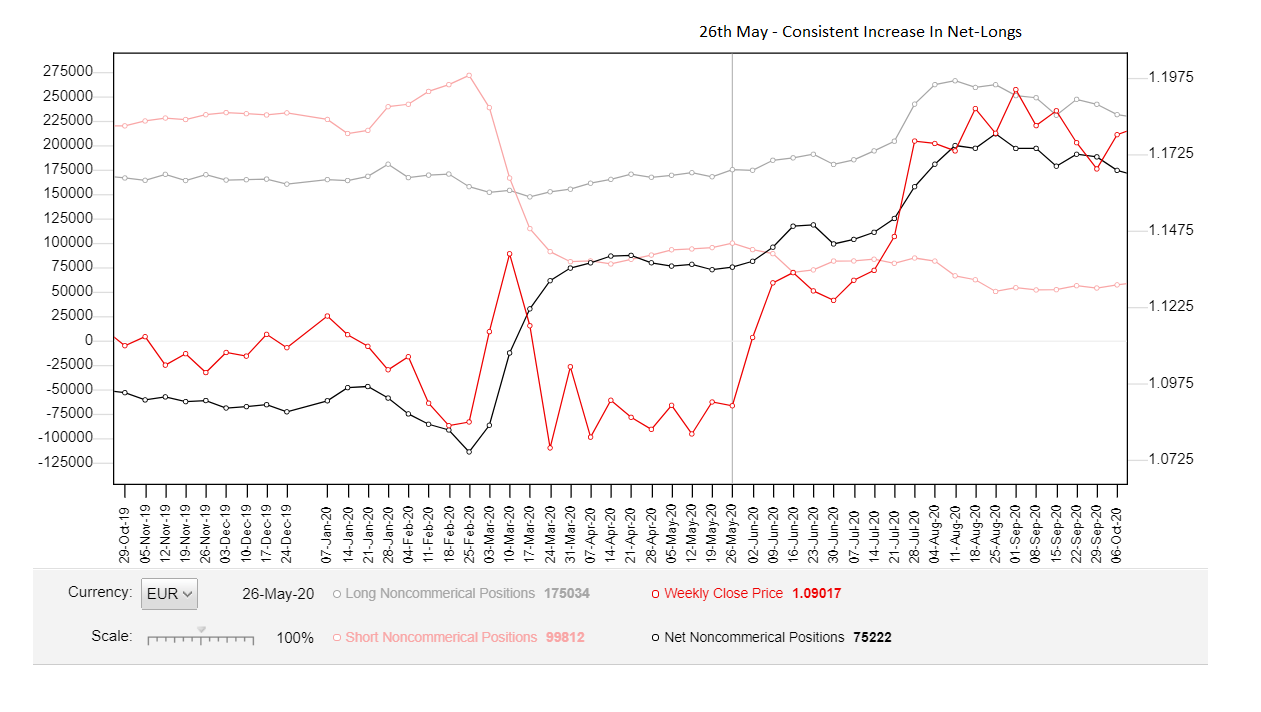

Price is moving higher, but how can we be sure this isn’t just another retracement?

The COT graph holds the answer.

If this is a genuine new up-trend, we should see a steady increase in net longs. This tells us the smart money are accumulating buy positions, signaling confidence in further upward movement.

Let’s examine the COT data and see what the “smart money” is up to…

Switching to

Switching to

It’s undeniable: Banks are aggressively buying during this rise!

Since the reversal, we’ve had five COT reports, and each one shows a steady increase in net longs (buy trades) and a decrease in net shorts. This is textbook confirmation a trend or a major upswing is in motion, and price is likely to keep climbing in the coming weeks.

But identifying trends isn’t the only trick the COT graph has up its sleeve…

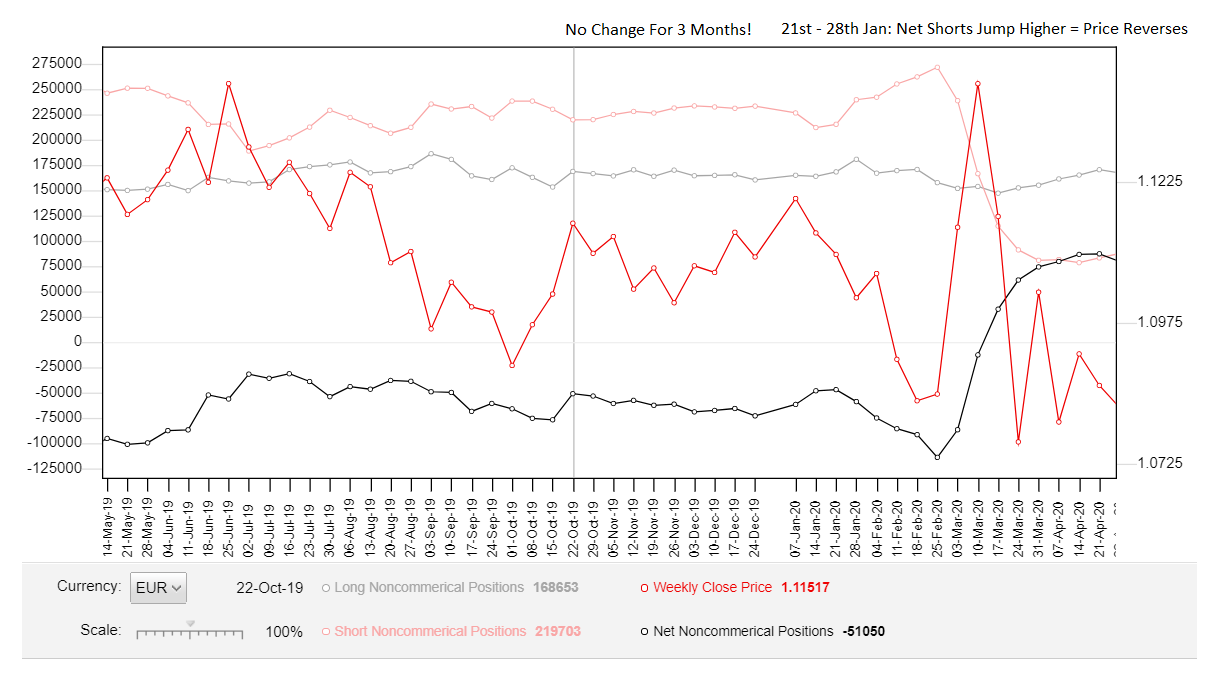

Between October 2019 and January 2020, EUR/USD was stuck in a consolidation – no clear, dicerneable trend in sight.

Looking back, it seems obvious, right?

But at the time, it was anyone’s guess when this consolidation would begin or how long it would last. Here’s where the COT graph comes in handy. If we rewind and examine the data from September 2019, we see the early warning signs of a brewing consolidation – a full month before it even started!

Let’s take a closer look at the chart…

For almost three months, there was virtually no change in net short and net long trades!

Every increase on one side was quickly countered by a similar decrease on the other, resulting in flat lines on the graph. This lack of movement among the smart money is a classic sign of consolidation – the market was stuck in neutral.

But look what happened on February 27th!

A massive spike in net short trades signaled a sudden shift in sentiment.

And what followed: A dramatic downward move!

The COT graph gave us a heads-up about the potential for a breakout, even before it happened on the price chart.

That’s the power of understanding institutional positioning!

Caution: High Open Interest Can Signal Trouble!

While a surge in open trades often indicates a strong trend, sometimes it’s a red flag.

If you see a significant increase after the trend has been running for a while – similar to what we’re seeing on EUR/USD right now (09/10/20) – it could be a sign of a blow-off top. Expect a deep retracement or even a full reversal in the near future.

Anticipate Major Trend Reversals

Every forex trader dreams of catching reversals before they happen.

The COT report can help you do just that.

The key is to watch for extreme readings in the net short or net long positions, particularly after price has been trending steadily without any major retracements or prolonged consolidations. These extremes, coupled with a mature trend, often signal that a reversal is brewing.

Let’s illustrate with an example…

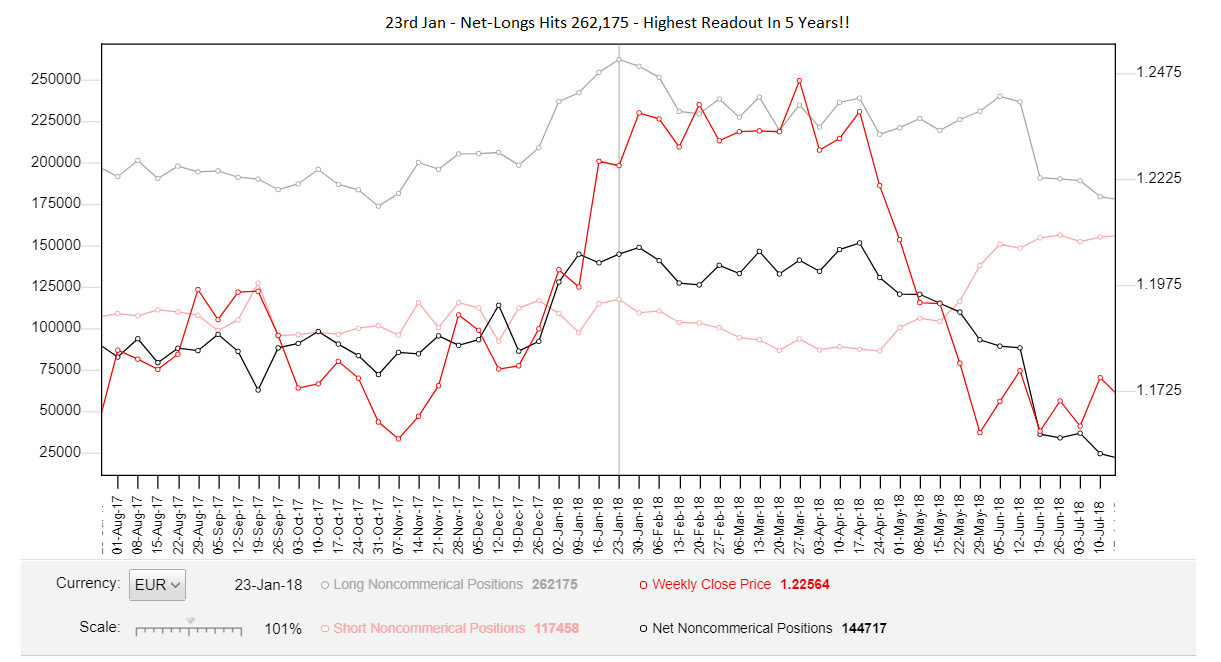

Remember that dramatic reversal on EUR/USD?

At first, it seemed like a clear bullish breakout, almost as if a new uptrend was about to take off. But a few months later, the market did a complete 180, leaving many traders scratching their heads. Technical analysis might have missed this reversal entirely.

The COT graph reveals some intriguing clues that something was amiss…

For six consecutive weeks, the net-long number kept hitting new highs.

Can you see that?

On January 23rd, it peaked at a staggering 245,000 – the highest reading in over five years!

With so many traders entering long, expectations for further price increases were sky-high. Why else would they be piling in?

But there was a subtle shift happening beneath the surface.

The number of net open short trades, after declining for a while, started creeping up for three weeks straight. This tells us some traders were starting to bet against the trend or beginning to unwind long trades opened during the uptrend.

Now, let’s put the pieces together:

Point 1) We had a prolonged uptrend with no significant pullbacks or consolidations – a important condition for a trend to continue, as I explain in my books.

Point 2) The number of open long trades was at a 5-year high, indicating extreme bullish sentiment.

Point 3) To top it off, net shorts were increasing – a sign traders were starting to see cracks in trend.

This combination of factors was a major red flag for the uptrend. While it didn’t guarantee a reversal, it certainly hinted at a potential shift in the market’s direction.

And then, as if on cue…

Bears take control, driving price down in two swift blows, the second managing to peak below the previous low and break the 1.22000 Psychological Level.

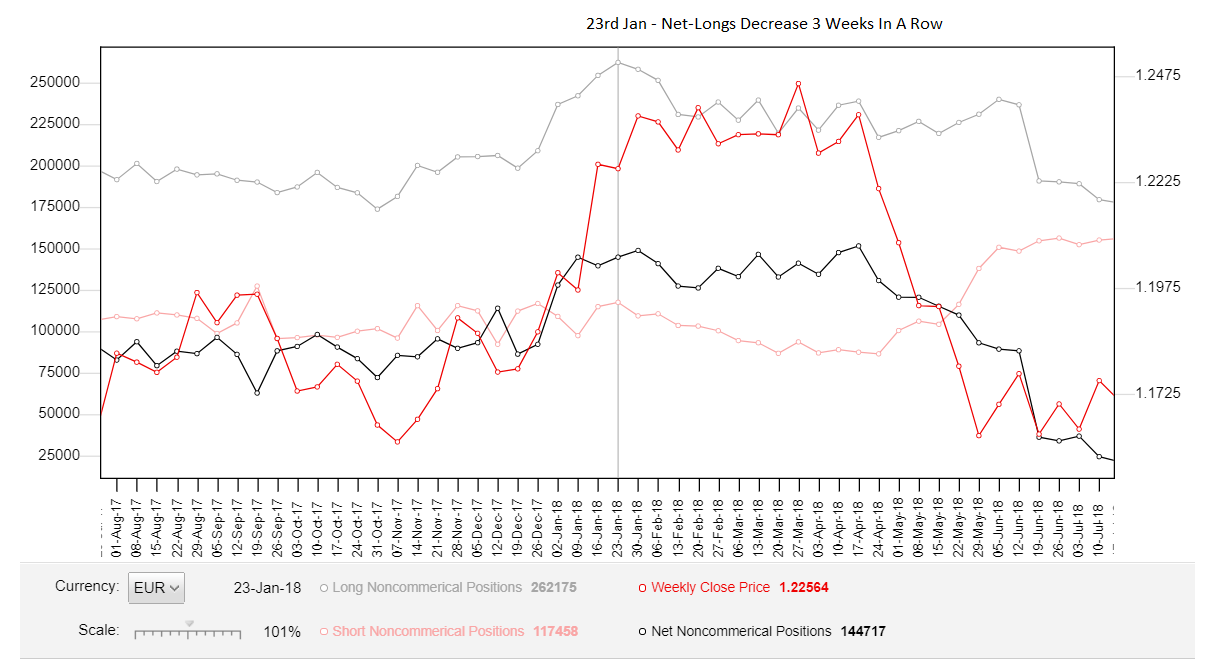

The graph also revealed the number of open long trades decreased for three consecutive weeks. Why would the smart money be closing long positions and increasing shorts when everyone is bullish and the market seems unstoppable?

It begs the question: Do they know something we don’t?

This divergence between the banks’ actions and the prevailing market sentiment is a classic red flag. It suggests smart money is positioning itself for a potential downturn, even as the retail crowd remains overly optimistic about the uptrend.

This kind of contrarian behavior is a signal that shouldn’t be ignored.

It’s a reminder the market is not always what it seems, and that following the herd can be a dangerous game.

Taken together, these signals painted a clear picture: a high probability of a downward move, either through a deep retracement or a full-blown trend reversal.

In this case, it was the latter.

After a three-month consolidation, the market reversed, and a new downtrend took hold. The COT graph provided the confirmation:

We saw a sharp DECREASE in net longs between April 17th and 24th. Why would banks suddenly dump their long positions? It was followed by a massive INCREASE in net shorts the next week, signaling they were aggressively entering short positions.

The writing was on the wall.

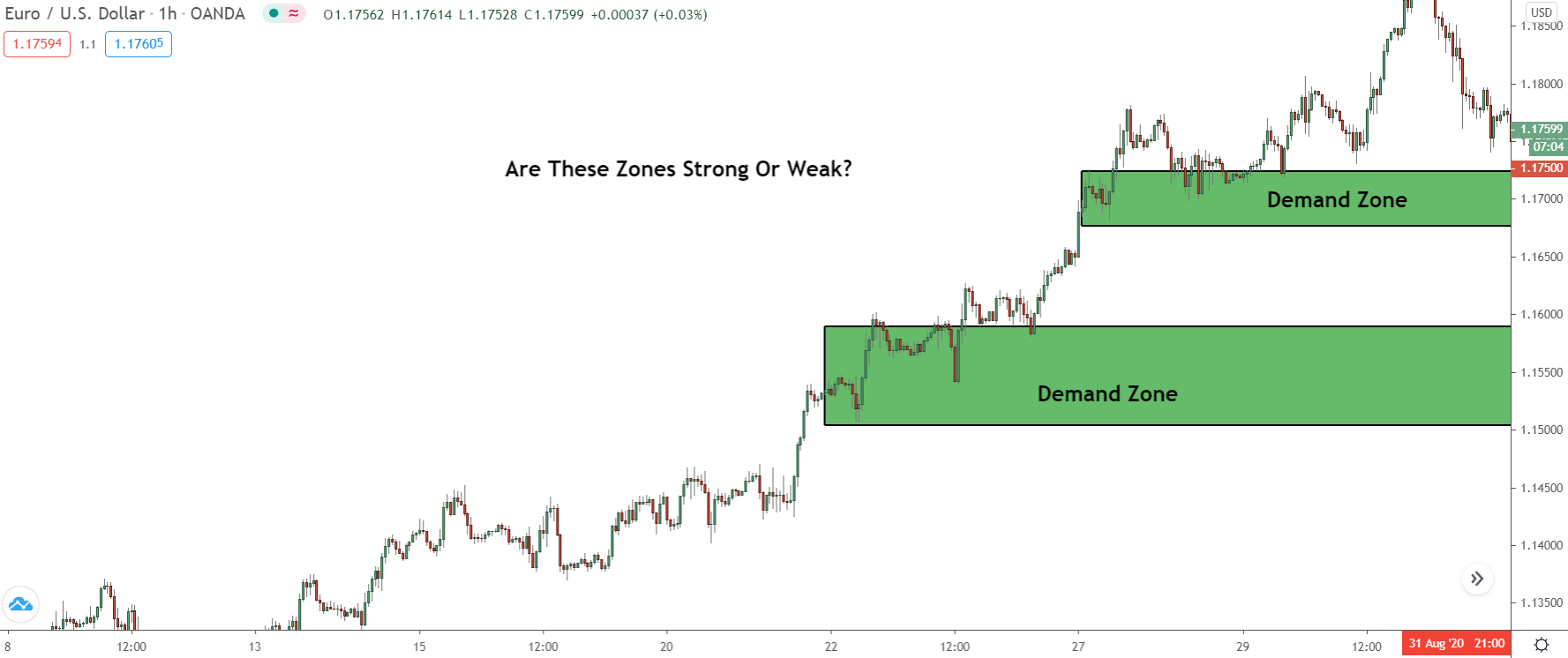

Finding High-Probability Supply and Demand Zones: The COT Connection

Identifying high-probability supply and demand zones is usually a tough task, but the COT graph can make it a whole lot easier.

By checking whether a zone coincides with a large increase in open long or short trades, you can quickly assess zone strength and prioritise the best zones.

Here’s what you do:

Head over to the COT graph and check if there was a significant jump in open SHORT trades (net short on the graph) around the time that zone formed.

If you see a spike, it’s a sign the zone is powerful.

REMEMBER: Banks can only sell when others are buying (and vice versa)

So, the increase in long trades tells us banks were selling into a rising market.

Look back at the chart – the only time price really declined during the uptrend (besides the little swings at the bottom) was during the retracement which formed the demand zone. Banks were likely entering buy trades during the small retracement which formed the demand zone.

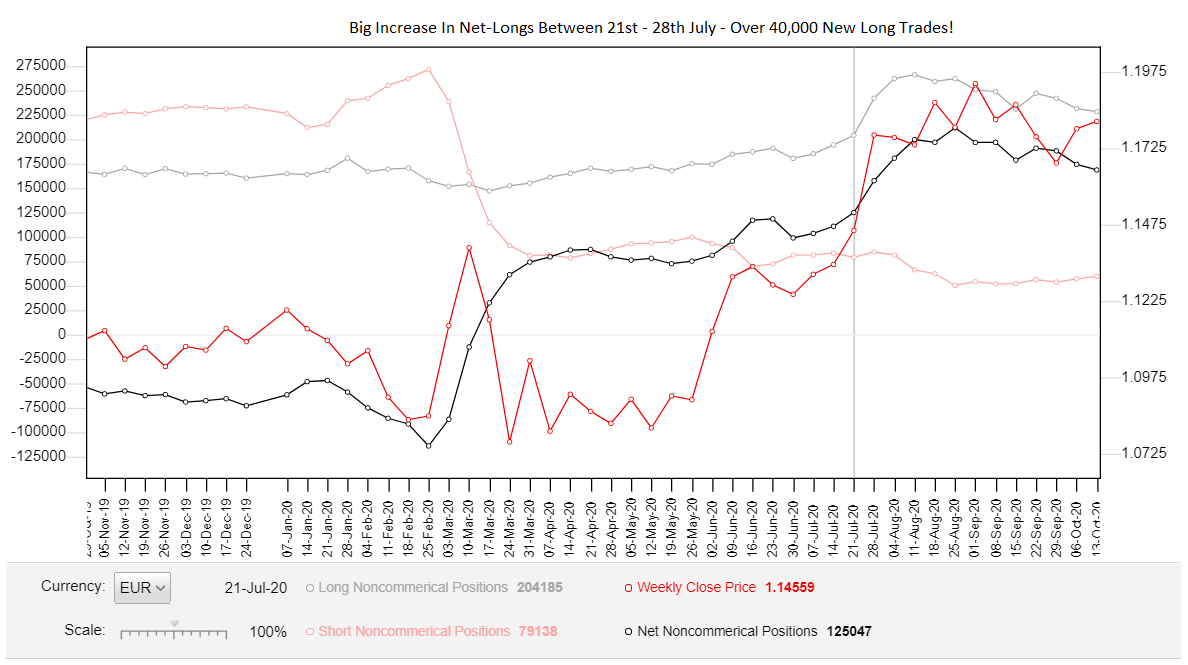

Let’s see what the COT graph shows…

Look at that!

There’s a clear spike in open long trades between July 21st and 28th, jumping by 40,000 new long trades.

That’s a considerable increase, indicating major bullish sentiment among the smart money, despite price falling and forming a retracement.

If price revisits this zone anytime soon, expect a high chance of a reversal.

The smart money have a vested interest in seeing price rise, thanks to the hefty long positions they’ve now accumulated.

Just as we expected: Once price returned to the demand zone, it reversed sharply, triggering another up-move from the retracement.

That’s the beauty of using the COT report to identify institutional zones!

Pro Tip: The demand zone was a Rally-Base-Rally (RBR) pattern, which many traders would overlook. However, the COT graph revealed smart money had placed a significant number of long trades within this zone, making it an institutional zone primed for a reversal.

Want to Learn More?

If you’re eager to uncover more institutional SD zones using the COT graph, be sure to check out my in-depth VIP Members post:

How To Find Institutional Supply And Demand Zones With The COT Graph

In this post, I’ll break down the process step-by-step, provide clear examples, and equip you with the knowledge to identify high-probability zones created by smart money activity.