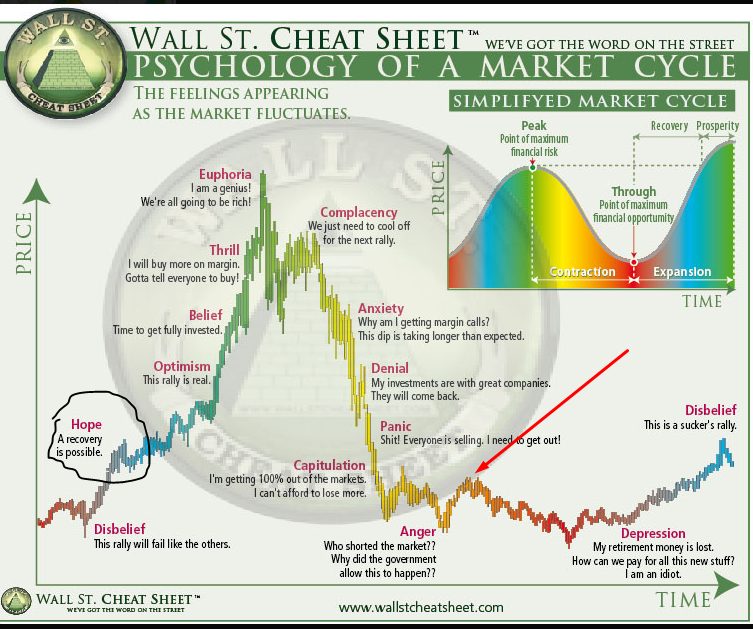

This is the Wall Street Cheat Sheet, a visual representation of the typical emotional market cycles traders go through during a trend.

The sheet highlights how these emotions influence our perceptions and decisions in the market.

It’s a revealing snapshot of the emotional rollercoaster traders often experience.

Can you see yourself reflected in any of those stages?

Quite insightful, wouldn’t you agree?

Let’s dissect each cycle in more detail to learn further insights that can benefit our trading.

Phase 1: Disbelief

Every new trend begins under a cloud of widespread pessimism and doubt.

Because of how badly they got burnt during the previous trend, most traders cannot accept a new trend could be underway.

They tell themselves…

“Yeh, I’ve seen this before…”

“No way, I’m not falling for this again!”.

Does this sound familiar?

Most of these traders are just newbies who can’t wrap their heads around the idea a fresh trend might be kicking off. To deal with this possible uptick, they brush it off, say “no way,” and downplay the trend.

Sure, it helps them dodge feeling bummed out, but it also keeps them from hopping on board and riding the trend.

— A major mistake, as we’ll see later.

Onto phase 2 now…

Phase 2: Hope

In phase two, price rises further.

By this time, some (but not many) burnt out traders swing round to the idea a new trend could actually be underway. Seeing price rise and break old highs give them hope and revitalizes their interest in the markets.

Prior negative thoughts suddenly become more positive:

“Hmm, maybe price really is trending again?”.

“Look, a new higher high – price must be trending again.”

As more buyers enter the market, price pushes higher. In an ironic twist of fate, that encourages even more traders to join the long side of the market.

Then, a consolidation forms.

For any Wyckoff junkies, this is the Accumulation phase.

With promising evidence a new trend now exists (the rise), pro traders start accumulating long positions, ready for when price takes off. The back and forth action causes a consolidation to form. Once the banks have loaded their positions, price breaks out, and phase 3 begins.

Phase 3: Optimism And Belief

Here’s where things get tasty…

After the consolidation, price EXPLODES higher.

God dang, look at it go!

Traders who were hopeful suddenly become unwaveringly optimistic, fueling the rise and inciting additional traders to buy. Retail and professional traders who missed the consolidation rush into long positions to capitalise on the new trend.

The result? Phase 4…

Phase 4: Total Euphoria

Now, we reach the Euphoria phase, or, as I like to call it:

The FOMO phase.

FOMO stands for “fear of missing out”.

Have you ever entered a trade because the price was moving quickly and you didn’t want to miss out on a profitable opportunity?

Yeh, that’s FOMO.

During the FOMO phase, retail traders still on the fence finally cave in and enter long into the uptrend. Why do they enter long now?

FOMO – they don’t want to miss out!!

The sharp rise confirms (to them) a new uptrend is now underway. The negative memories from past trends disappear and get replaced with euphoric visions of success. They enter ASAP to capture what they believe is a ride to the moon and riches.

However, price soon changes…

Phase 5: Complacency

After Euphoria, complacency sets in.

“OMG, price is down; time to buy again.”

“Quick, gotta BUY BUY BUY!”

…We’ve all heard this before.

Price soon falls from the highs, but do most traders care?

YOU CAN BET YOUR ASS THEY DONT!

A lot of traders see that dip as a sweet chance to double down and pile on more long positions in that uptrend. No biggie, it’s just a tiny hiccup before the trend gets back on track. You know what they say—price is heading to the moon!

Phase 6: Anxiety & Panic

After a small rebound, price falls sharply.

How do most traders react?

PANIC! PANIC! PANIC!

The drop shows that the uptrend might be over, which puts most late long traders in the red and causes widespread panic. Stops trigger, margin calls execute… everyone wants out ASAP to avoid as much damage as possible.

But how do you close a losing long trade?

By SELLING what you bought at a worse price.

What effect does the exit of thousands of losing long traders, along with a few opportunistic shorts, have on the market?

It FUELS the downmove.

The losing longs are closing their trades, sending the market lower. That pushes price against the longs who bought earlier, causing them to exit. More shorts now enter the market, adding further downside pressure.

See how the market is like a giant feedback loop?

(We’ll come back to this later).

Phase 7: Capitulation/Anger/Depression

“How could the market change so quickly!”

“How did the price reverse when it was taking off?”

Most traders eventually capitulate and surrender to the new downtrend, stunned by the sudden decline and how quickly the trend changed.

Many are ANGRY, others DEPRESSED.

Many traders struggle to come to terms with the market, which can make them feel like kings one day and then crush them the next. Some continue to hold, hoping for a price recovery… HODL or nothing, as crypto traders say!

After a while, the market comes full circle…

Phase 8: Disbelief (Again)

Finally, the cycle completes.

Now, Phase 1 repeats again…

After a drawn out consolidation, price begins ticking higher.

A new trend, perhaps?

NOPE – not for these traders.

With the crash still fresh, traders are sceptical of the rise. Burned out from the crash, they dismiss the new rise as a suckers rally – “it’ll fall soon, just watch!”

What happens next?

….you know the answer.

See how the market cycles between phases now and how that influences the price movement we see?

Emotions > buying/selling > price movement.

Emotions drive traders’ buying and selling, which moves prices.

That movement then impacts how traders perceive the market, altering their emotional state, such as becoming more optimistic. This, in turn, affects where and when they decide to buy and sell in the future, influencing price movement.

That is how the market operates – it is one giant feedback loop!

Pretty crazy, right?

The Bottom Line

Use the Wall Street Cheat Sheet as a valuable tool for understanding market psychology. While every situation is unique, the emotions driving traders remain consistent across different markets and timeframes.

Remember this fundamental principle:

Emotions influence buying and selling decisions, which ultimately drive price movements.

This is the core of how markets function, and it’s a timeless truth.

Wall Street Cheat Sheet FAQ: Your Questions Answered!

Struggling to understand the emotional rollercoaster that drives market cycles? This FAQ tackles your some common questions, providing useful explanations and practical tips to improve your trading approach.