Most people understand support and resistance levels as lines marking points where price has previously reversed. This traditional definition is widely recognized, but there’s another type of level at play that’s often overlooked:

Round numbers.

In this post, I’ll explain why big round numbers act as effective support and resistance levels and how you can leverage them in your trading strategy.

How Do Support And Resistance Levels Form At Round Numbers?

Round numbers might seem like unlikely candidates for support and resistance levels because, after all, they’re just numbers. However, these numbers often trigger interesting market dynamics that make them great for spotting support and resistance.

First, let’s clarify what we mean by ‘big round number’.

We’re referring to any price that ends in 00, 000, or 0000.

While numbers ending in a single 0 (like 1.2340) are technically round numbers, they hold little significance and aren’t typically used as support or resistance levels.

So, what makes these numbers such effective support and resistance levels?

Consider this: If you bought a car for 34,899 and someone asked you how much it cost, you’d likely say approximately $35,000. You round up to the nearest whole number because it’s simpler to remember (and perhaps makes your new purchase sound a bit more impressive).

Interestingly, traders and investors do the same when placing their orders.

They prefer to set their orders at easy-to-remember, rounded numbers rather than at complex, specific prices.

This rounding up leads to a significant accumulation of buy, sell, and stop-loss orders at big round number prices.

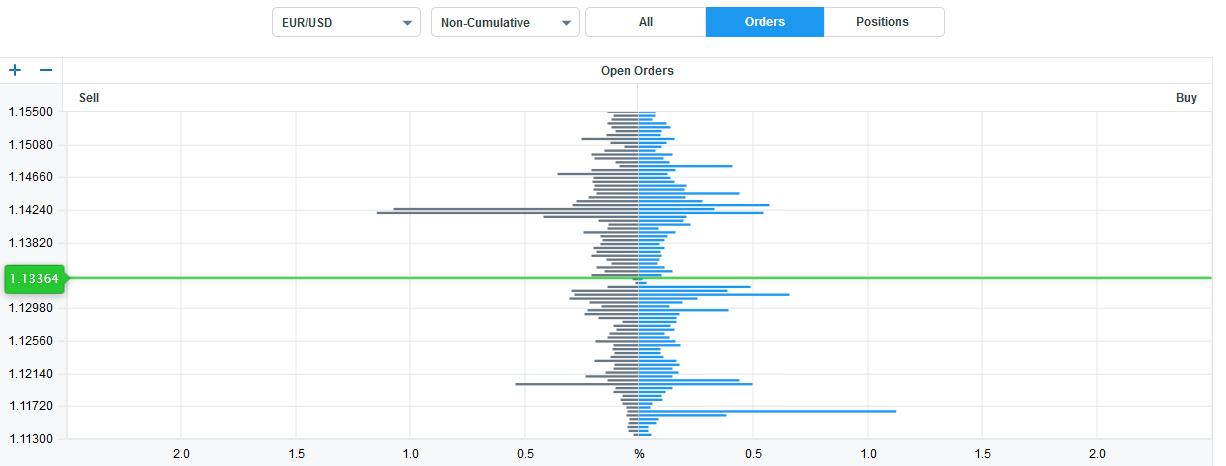

For instance, take a look at this historical order graph, a tool showcasing where Oanda traders placed their stops on EUR/USD.

See the large bars?

They indicate a high concentration of orders at round number prices, such as 1.13000 and 1.12000.

This evidence confirms the market’s tendency to place buy, sell, and stop orders at big round numbers, demonstrating their significance as support and resistance levels.

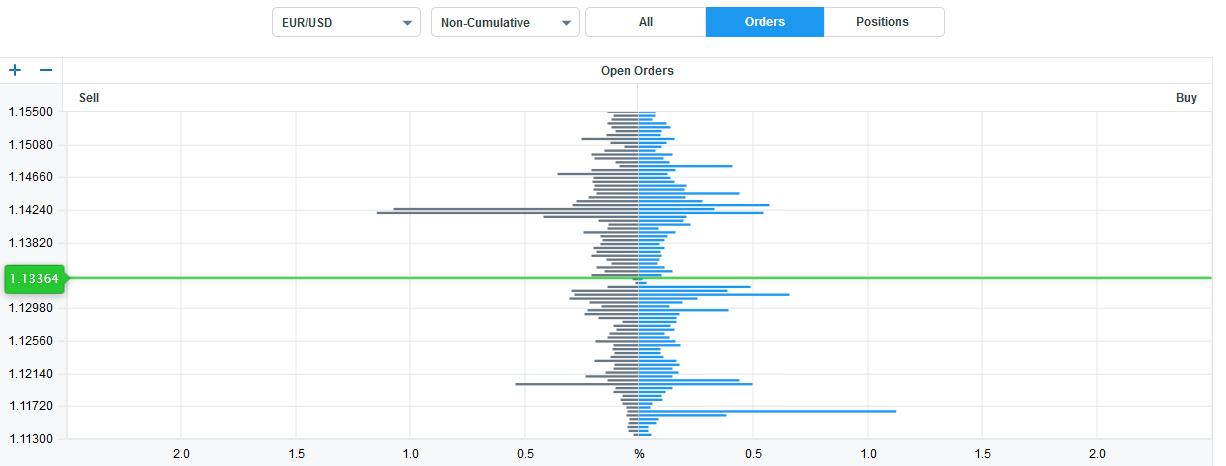

The most orders—represented by deep red patches—are concentrated at significant round number prices, like 1.2300 and 1.2340 in this case.

This snapshot from a few years back shows traders mostly placing their buy, sell, and stop orders at these round numbers, also confirming their market importance.

Take a look at this recent picture from Oanda’s Order-book tool:

Notice how the largest bars—representing buy, sell, and stop orders—all cluster at round number prices?

As demonstrated, considerable amounts of buy, sell, and stop-loss orders accumulate at round numbers, making them powerful support and resistance (S&R) levels.

So, how can you leverage these levels in your trading?

Let’s explore…

Using Big Round Numbers As Support & Resistance Levels

Using round numbers as S&R levels is essentially the same as using standard levels: identify the numbers on the chart and monitor price movements around them.

Keep in mind, however, not all round numbers are equal.

Certain numbers have a higher likelihood of prompting price reversals due to their market significance. Typically, prices ending in 500 and 000 trigger the most substantial reversals.

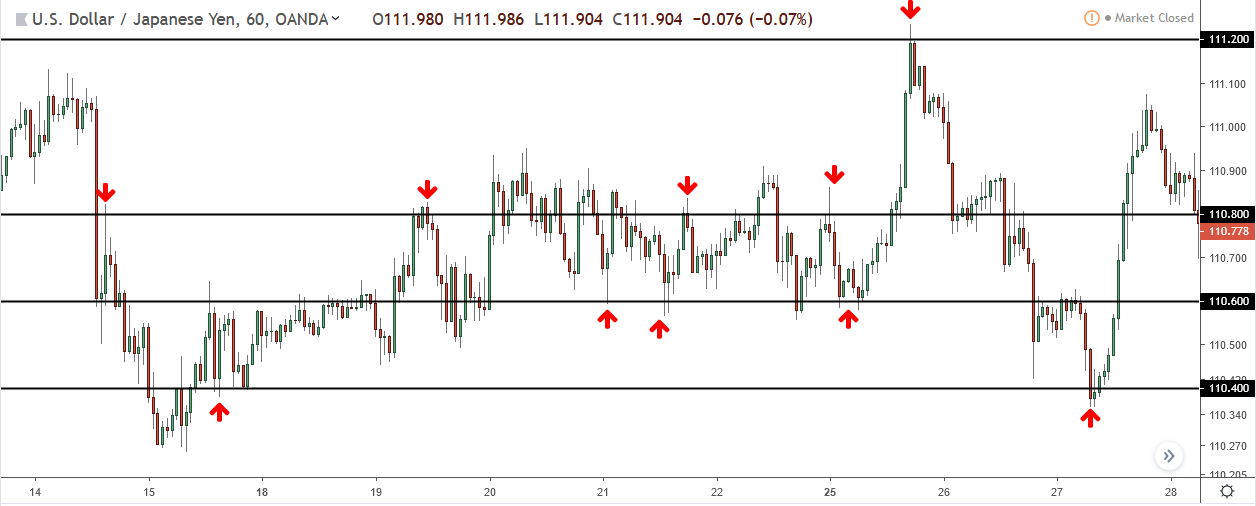

For instance, examining Eur/Usd reveals the most significant price swings between the 18th and 5th occurred near 500 or 00 prices.

While 500 and 000 prices often catalyze the most dramatic reversals and warrant primary attention, don’t disregard the 200, 400, 600, and 800 prices—they can also instigate significant shifts…

However, they’re less consistent, so don’t rely heavily on them.

Mark The Numbers As Zones For Easier Entries

Support and resistance levels function well as lines but work even better as zones, including round number support and resistance (S&R) levels.

Here’s an image of Eur/Usd with the 500 and 000 levels highlighted as lines.

And here it is again, but with the levels marked as zones.

Notice the difference?

With the numbers marked as lines, the price often significantly breaks below the line before reversing or entirely misses it – a common occurrence with regular support and resistance levels.

However, when depicted as zones, this rarely happens, making trading with big round numbers significantly easier.

The Bottom Line

In conclusion, big round numbers are beneficial for identifying potential reversals, and I highly recommend incorporating them into your strategy.

While the 200, 400, and 800 levels can be effective, I believe focusing on the 500 and 000 levels is most beneficial due to their potential for triggering major reversals.

These are crucial points to consider in your trading approach.