Hi PAN, thank you very much for the answer.

To be honest, the distance of the market from the zone troubles me more – especially when there are so many opportunities to create the liquidity for the bank traders: false breaks of swing highs/lows creating swings in a chop market, which form solid SR lines, which can be used for false breaks => sucking the breakouters liquidity into the market, creating false short time momentums against the direction, which bank traders want to go => sucking trendfollowers liquidity into market, and on and on….

What I am trying to say is, that when the market is distant enough from its original zone, it seems to me that bank traders have so many different opportunities to create the needed liquidity, that they might not have to bother with moving the market all the way to the zone. Personaly, at the moment I

x

But when the market looks more like this: somehow, I am a bit reluctant to expect, that this zone is still valid and after all that price action far away from the zone, bank traders would realize that they don’t have enough positions and would like to return all the way to the zone.

They had plenty of occasions to lurk breakout traders and trend followers into various traps and capitalize on this liquidity.

It often seems to me more probable, that in such cases they took their profit the zone is not valid. But I do not mean it as a statement, but more like my confusion when reading the price action. Why would they dance so much far away from the zone, and only then want to return to the zone for the rest of the unplaced positions?

Do you have experiences that the zones are still alive even after such distant price actions?

I would be gladful for the answers and also for the info about some another upcoming ebook? 🙂 I’d like to buy it. The ebooks so far gave me a lot, especially the commented charts helped me to view the markets from the aspect of bank trader.

Thank you very much and thanks for your vision and project.

My Response:

I’d say sticking to trading the returns into the zone seems to be your best bet.

The reason why is simple:

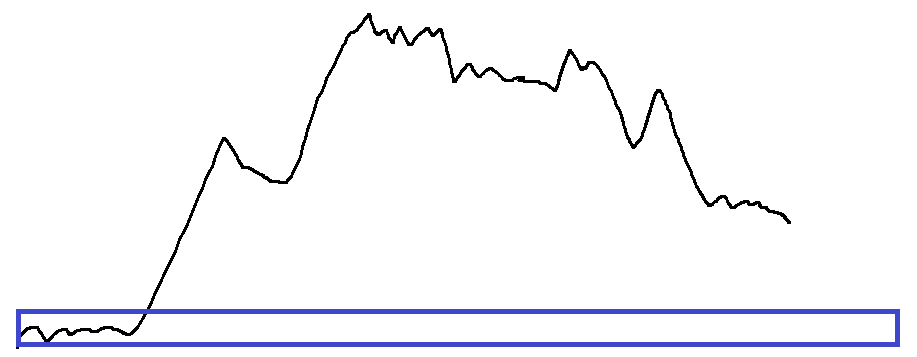

These returns usually happen right after the creation of the zone.

When you look at the zones in your second image, you’ll notice the returns take a while. And, as you’ve rightly pointed out, it seems counterintuitive for banks to push the market back into the zone… especially after having plenty of opportunities to generate liquidity by other means—like trapping breakout traders and trend traders.

Hope this helps!

PAN.